I wrote this as a comment in another thread, but I thought it might deserve its own post. This is how I think about saving for retirement, given a fairly difficult scenario. I'm open to feedback, suggestions or criticism, and I'm curious to see if others think about this differently.

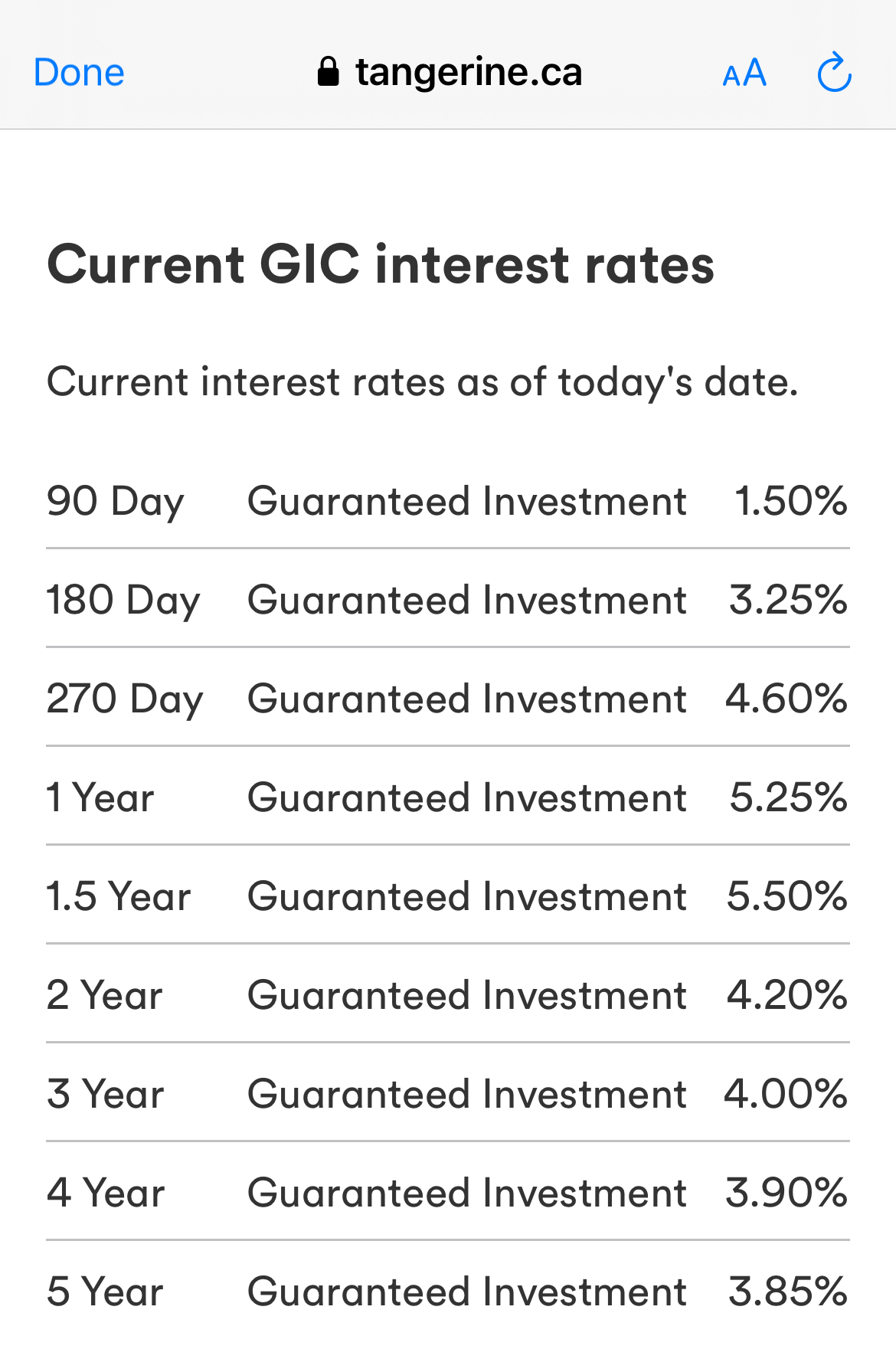

I assume that $34,000 hits your bank account and that you're only able to save $1,000 into a savings account of some kind. If this can be extrapolated to a trend, you can expect your investments to grow by $1,000 per year, but also with a compounding return. If you invest it in a savings account, a GIC, a bond fund, a stock fund or a high-flying stock, you'll expect different returns. You need to build that up until there's enough to last for your retirement. There are two ways to think about that: having enough for 20 years (or some fixed duration) or having enough forever, which means some will certainly be left over. I pick 20 years as an example, because that would be age 65 to 85 (median life expectancy) and for 50% of people that's enough.

But before we figure out how much money you'll need in retirement, let's think about what the government will provide. (Disclaimer: government programs could change.) OAS pays you just for living in Canada for 40 years and turning 65. If you do that, you'll get about $700 per month (in today's dollars) for the rest of your life, and it's indexed to inflation. CPP depends on how much you paid in. If you continue earning $34,000, that's about 50% of the pensionable maximum, so you'd get about $600 per month, indexed, for life. You can increase both of these amounts by starting later, so if you're not ready to retire at 65, you could receive a higher guaranteed income. $700 + $600 = $1300 x 12 = $15,600. You're already almost halfway there (but we still need to account for taxation). If that's all the income you receive, there will be almost no taxes, and the government will also offer GIS, the guaranteed income supplement. I'll let you look that up.

So now we need to account for taxes. If you want to spend $33,000, you need to earn about $38,000 (depending on your province). You'll pay $5000 in tax and be left with $33,000 to spend. You'll need $22,400 of your own money in addition to the $15,600 from the government. Ignoring inflation and investment returns (if your money is in a GIC, they're roughly the same), you would need $448,000 (22,400 x 20) to create that income. If you're saving $1000 per year for 30 years, you would need a 15% interest rate / rate of return to make that work. That's not realistic, so you'd either need to save more, work longer or spend less in retirement. For example, if you have 40 years instead, you "only" need a 10% return.

Here are a couple suggestions for a person in this situation.

- You could invest in an RRSP. This would give you a tax return, which you could also invest. That would boost your savings rate from $1000 per year to $1250 per year. But your tax rate is relatively low, so it's not necessarily better.

- You could invest in a TFSA. This way, the growth is all tax-free, and so is the income in retirement. Instead of $38,000, you would only need $34,000.

- You could set up two savings accounts. For example, have a TFSA that holds long-term investments and have a savings account at the bank where you can move money back and forth from your checking account. Every month, move $75 to the TFSA. But also move $25 or $50 to the savings account. If you need it, you can still access it. But if it's still there at the end of the month (or two or three months later), you can make an extra contribution to the TFSA.

- This is difficult, but you could keep looking for better work, or work casual part-time at a second job. Just an extra $100 per week of savings can make a huge difference over 30 years. But I know it's not easy to find a good job or to work more than full time.

That was a difficult scenario. My suggestions may not be very helpful (and remember that I'm an internet stranger), but hopefully you can see how I think about it.