The US Department of the Treasury issued a semiannual regulatory agenda on August 16, 2024, proposing a revised definition of “money” to include cryptocurrencies and other digital assets. This redefinition essentially brings cryptocurrencies under the same legal and regulatory framework as traditional fiat currencies; they will now be subject to regulations like the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML).

It seems more like a move to level the regulatory playing field between digital assets and fiat currency. And close chasm that exists between both regulatory wise.

But is that all to it? Is it feasible? Will it work? These are questions that need answers.

Crypto operates in regulatory gaps that needs to be closed

This seems to be what the U.S. Treasury believes. Its agenda introduces stringent reporting requirements for financial institutions dealing with cryptocurrency transactions, with the aim of closing regulatory gaps that have allowed some crypto activities to occur outside traditional oversight.

- Financial institutions must now maintain detailed records of all cryptocurrency transactions. This includes identifying the parties involved, recording the transaction value, and noting the nature of the transaction.

- Similar to existing regulations for fiat currencies, any suspicious activities involving cryptocurrencies must be reported to the Financial Crimes Enforcement Network (FinCEN). This includes large transactions exceeding $10,000, frequent transfers, or any patterns of behaviour that may indicate money laundering or other illegal activities.

- The revised regulations will place greater emphasis on cross-border cryptocurrency transactions, which will now be subject to stricter reporting and monitoring. These rules, akin to those governing international wire transfers of fiat currency, are expected to encourage more cooperation between global regulatory bodies.

What are the potential benefits of closing these gaps?

One of the primary benefits of the new regulations is the increased transparency they bring to the cryptocurrency market. By requiring detailed reporting and tracking of crypto transactions, these regulations can help illuminate the flow of funds and uncover illicit activities, such as money laundering and fraud.

For example, if crypto exchanges must disclose transaction details, it becomes easier to identify suspicious patterns and ensure that funds are not used for illegal purposes. This transparency can help build trust with investors and the general public, leading to a more stable and credible market.

The regulatory changes are also expected to improve the security of cryptocurrency transactions. By implementing stringent compliance measures, financial institutions can better protect users from fraudulent activities and cyber threats. For example, exchanges may be required to adopt advanced cybersecurity measures and conduct regular audits to safeguard their systems. This increased focus on security will not only protect individual investors but also help secure the broader financial system against disruptions caused by hacks or breaches.

Aligning cryptocurrencies with established financial regulations could contribute to greater financial stability. By integrating digital assets into the traditional financial system, the new rules can help reduce systemic risks and prevent market manipulation. Clear regulatory guidelines may help mitigate the volatility that has historically plagued the cryptocurrency market, as they can prevent unregulated or opaque trading practices. In the long run, this regulatory clarity could encourage more institutional investors to enter the market, bringing with them greater capital and stability.

Another potential benefit of these regulations is improved consumer protection. By holding cryptocurrency exchanges and wallets to higher standards of transparency, the new rules will ensure that users are fully informed about the risks and fees associated with digital asset transactions. This could protect users from unexpected costs or fraudulent schemes, increasing their confidence in using digital currencies.

What does this mean for the future of money?

If successful, this integration could lead to a future where digital assets are not just alternative currencies but operate seamlessly alongside fiat in everyday transactions. This may create new hybrid financial products, expand consumer choices, and accelerate financial innovation.

However, crypto doesn’t exactly fit neatly into our current definition of money. It has its quirks and differences that make it different from what we know and truly using it in the best way possible would require that we update our definitions of money. So there will be a problem will this move by the U.S. Treasury.

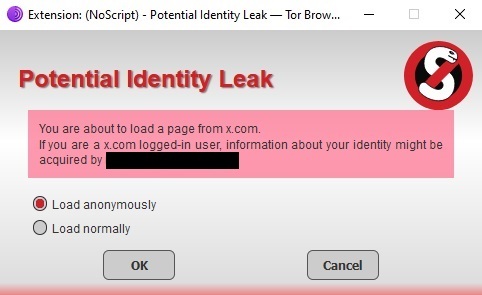

One of the most significant concerns is the impact on privacy and anonymity, which have been central to the appeal of many cryptocurrencies. As digital assets are redefined as “money” and subjected to stringent reporting requirements, transactions may become less private. This could deter users who value the anonymity offered by cryptocurrencies like Monero or Zcash. Striking a balance between regulatory oversight and user privacy will be critical in maintaining crypto’s unique appeal.

If we assume the Treasury could successfully achieve its aim, the road to regulatory parity is fraught with challenges. One immediate concern is the cost of compliance. Market participants will be required to invest in advanced technologies to track and report transactions. Smaller firms, such as boutique exchanges, may find these costs prohibitively high, leading to increased operational expenses or even forcing them out of the market. Larger firms with more resources, like major exchanges, will likely dominate, which could reduce market competition and diversity.

On the other hand, traditional financial institutions will need to adapt their systems to accommodate cryptocurrency transactions, a task that requires significant investment in new technologies and infrastructure. Cryptocurrencies, being decentralized and often anonymized, do not fit neatly into existing financial frameworks. Incorporating them into traditional financial systems will likely involve developing or adopting new tools, such as blockchain analytics platforms, to ensure compliance with the new regulatory standards.

Also, achieving global alignment will be critical to the success of the Treasury’s efforts. Cryptocurrencies are borderless by nature, often transacted across jurisdictions with different legal frameworks. Without coordinated international regulations, regulatory arbitrage will emerge—users and institutions will shift activities to countries with less stringent rules.

It will also place undue burdens on financial institutions trying to comply with both local and international regulations. For example, while one country may adopt strict regulations for cryptocurrency reporting, another may have more lenient or unclear rules. If one country enforces strict rules on cryptocurrency transactions while a neighbouring country adopts a more lenient approach, individuals and businesses could exploit these differences to bypass oversight. The end result would be creating loopholes that undermine the very regulations meant to bring transparency and security to the market.

Final Thoughts

The U.S. Treasury’s attempt to redefine money by including digital assets represents a significant step toward bridging the gap between crypto and fiat. However, the challenges of implementation—privacy concerns, compliance costs, and global coordination—highlight the complexities involved. How the Treasury plans to solve them is worth watching because if it succeeds we might have to update our understanding of money and crypto. The next steps in implementing this framework will be crucial in determining whether this move was well thought out or not.

From: https://coinmarketcap.com/community/articles/67560e886e4ee6540d66072d/

Yes, if everyone you know who is open to future technology has a Monero in their own wallet on their own device and uses it to pay for goods and services that accept Monero.