this post was submitted on 07 May 2025

197 points (95.0% liked)

Comic Strips

17149 readers

639 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- [email protected]: "I use Arch btw"

- [email protected]: memes (you don't say!)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

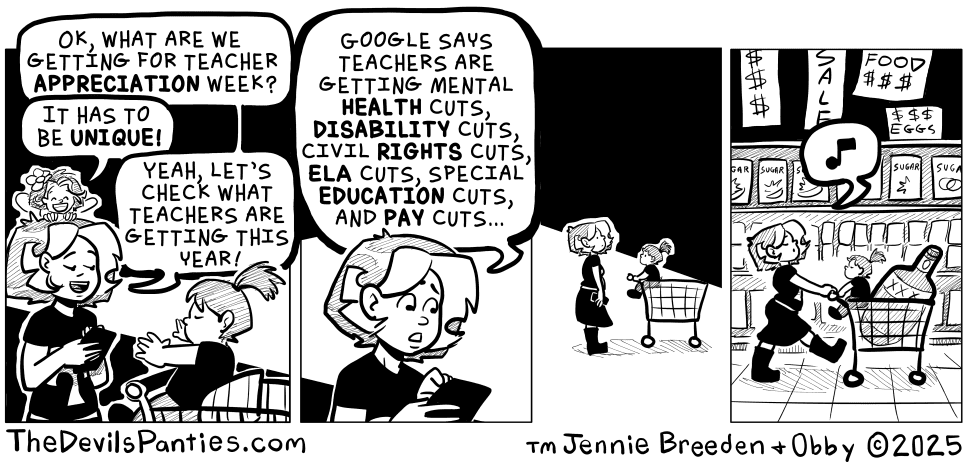

Don’t business people get to write off lunches and shit if they are “business related”?

And just find me a teacher that spends last than $300 to kit out their classroom. I think the pizza party I threw cost more than that.

It is insane to me that the teachers have to pay for any of it.

My wife is a teacher. About 2k per year of our own money goes to fund basic supplies in her classroom.

By basic I literally mean pens, paper, soap, folders, erasers, backpacks.

We also keep a little food stocked in her classroom for kids with blood sugar and nutritional issues, since it's a very poor income district, but I wasn't including that when I last did her expenses since it comes straight from our grocery budget.

That's fucking nuts.

Yeah dude. Be nice to teachers because they literally bleed for their students. ( Most of them)