An eligible educator can deduct up to $300 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers (including related software and services) or other equipment that the eligible educator uses in the classroom. Supplies for courses on health and physical education qualify only if they are related to athletics.

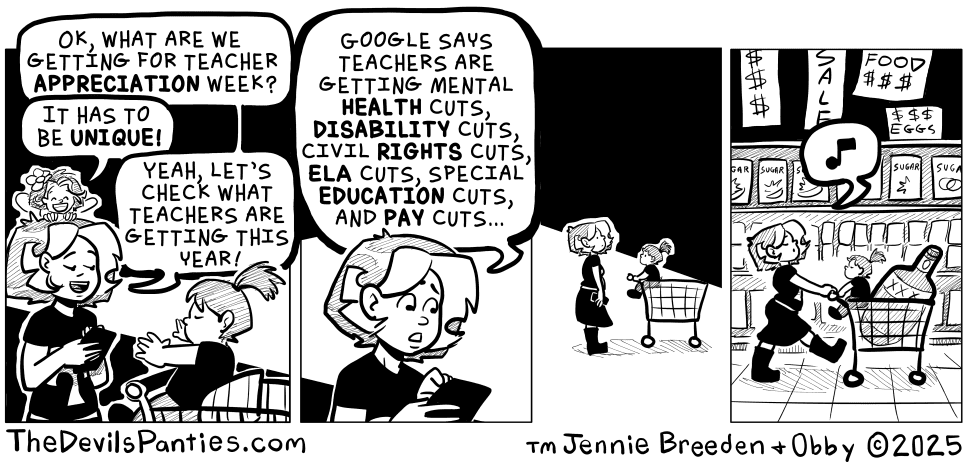

Don’t business people get to write off lunches and shit if they are “business related”?

And just find me a teacher that spends last than $300 to kit out their classroom. I think the pizza party I threw cost more than that.