Wealthsimple now offers 4% for ALL Cash clients

Previously: 1% for all clients, 3% for direct deposits over $500, 4% for $100,000 net deposits

Now: 4% for all clients, 4.5% for $100,000 net deposits, 5% for $500,000 net deposits

Wealthsimple now offers 4% for ALL Cash clients

Previously: 1% for all clients, 3% for direct deposits over $500, 4% for $100,000 net deposits

Now: 4% for all clients, 4.5% for $100,000 net deposits, 5% for $500,000 net deposits

Thank you for your input! I didn't realize that net worth in stocks, GICs, HISA & registered accounts could be considered eligible assets for borrowing in Canada, which is fantastic. I'm definitely going to look into this further.

Regarding Interactive Brokers, I have some reservations about their management style, especially after their chairman, who is also their largest shareholder, criticized retail investors during the GME short squeeze, suggesting that normal people buying and holding a stock and causing a squeeze is manipulation. It makes me question their trustworthiness.

I truly appreciate your insights and find them enlightening.

Thanks for sharing!

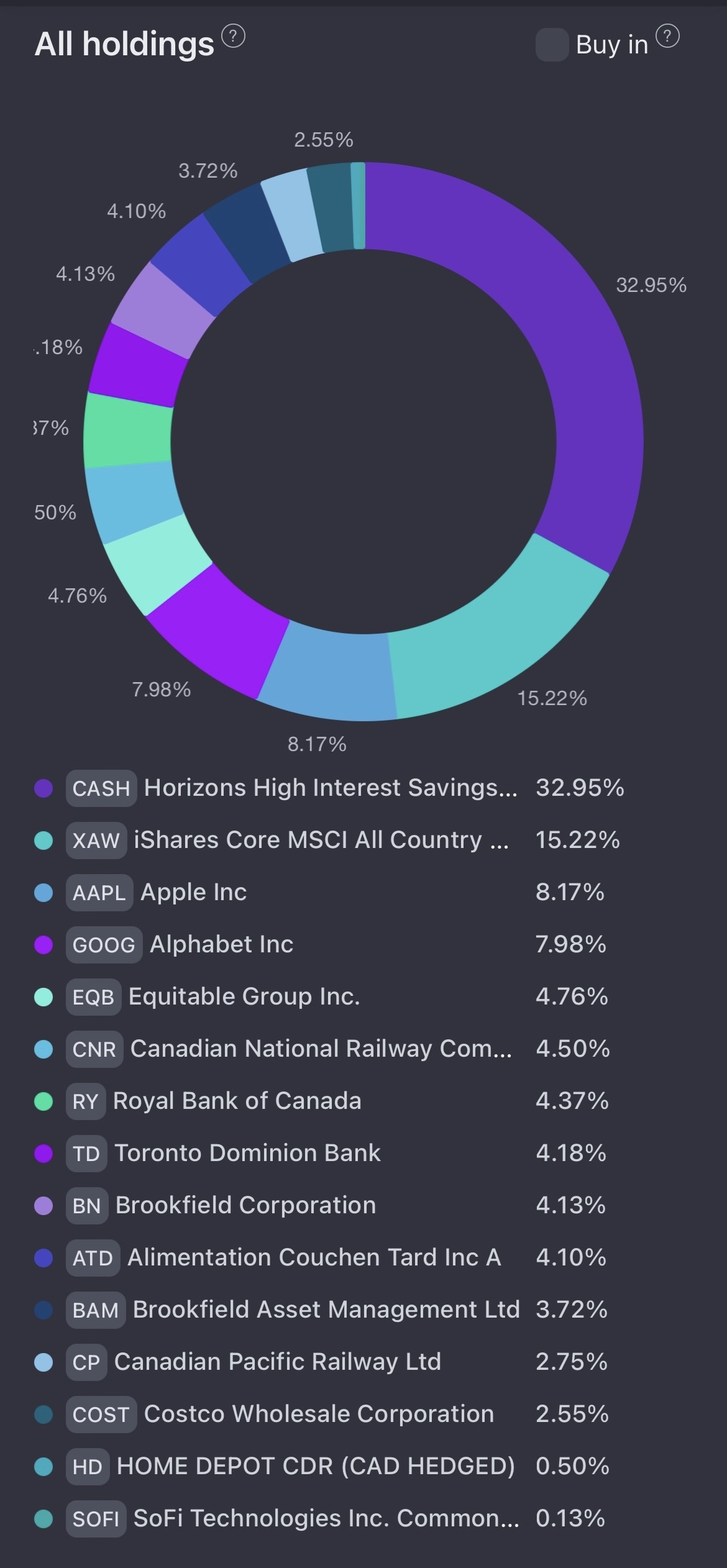

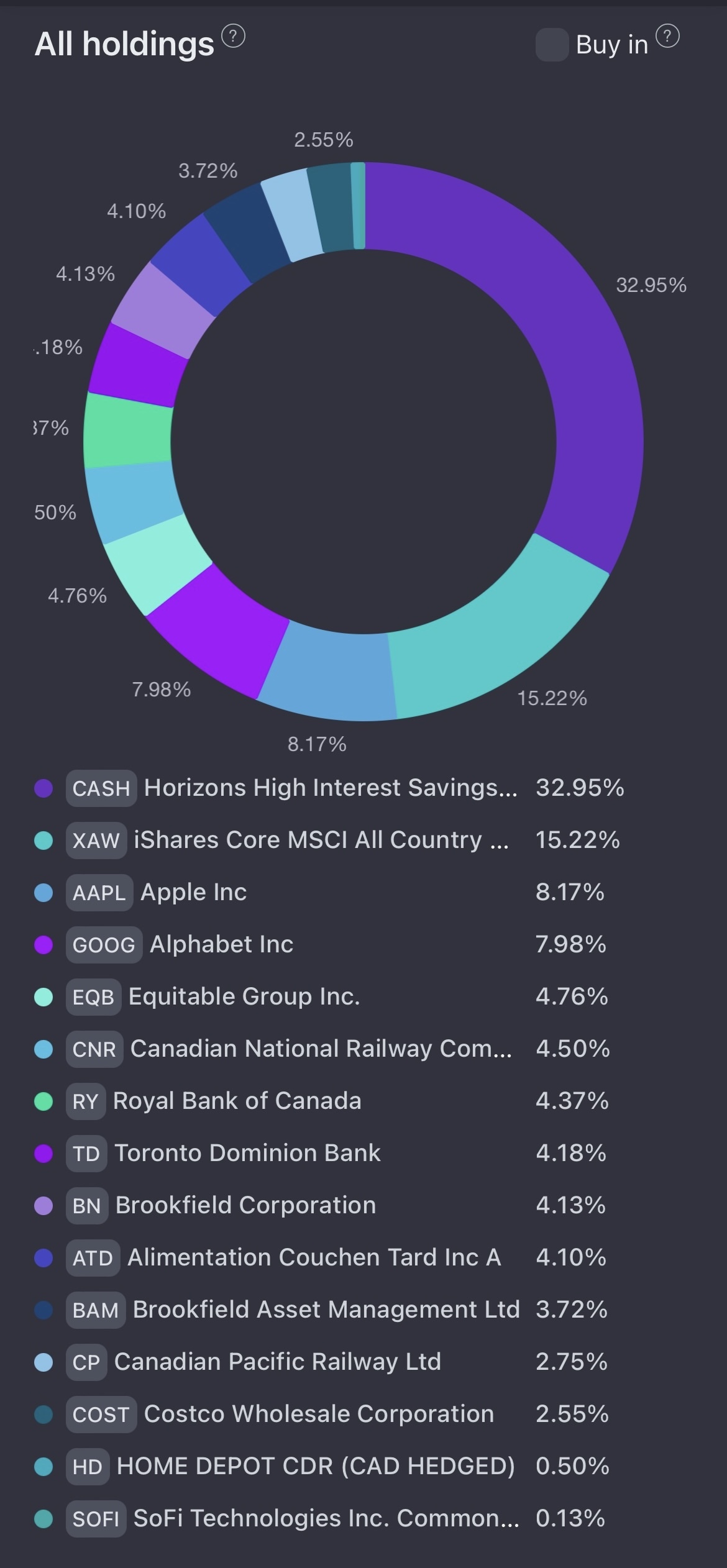

For anyone curious, here is what my current investment portfolio looks like,

250K

In my mid-30s, I have maximized my contributions to my TFSA and I am currently focusing on maximizing my RRSP this year. Additionally, I have invested some funds in an unregistered account.

I currently hold a significant amount of cash in $CASH.TO as I am saving up to purchase my first property.

Looking ahead, my long-term objective is to engage in dollar cost averaging by investing in $XAW.TO every two weeks over the next 20-25 years.

One-third of my portfolio is currently allocated to CASH.TO 😄

However, this is intentional as I am saving this portion for the down payment on my first property.

Up: Just $746 more and I'll hit a new milestone in my investment portfolio! 🤩

Down: I'm just $746 short of reaching that milestone in my investment portfolio. 😩

Horizon ETF $CASH.TO yield of 5.41% as of July 13, 2023 - Management fees 0.10%, (Plus applicable sales tax)

Do Horizon ETFs typically increase their $CASH.TO distribution soon after a Bank of Canada rate increase? I’m curious if you’re familiar with the historical trend behind it.

Tangerine extends promotional interest rate offers to existing customers as well. As a long-standing customer myself, I recently benefited from 5.25% offer just last month.

What!? Those bastards only offered me 5.25% I should file a complaint with ombudsman for banking services /s

Wealthsimple now offers 4% for ALL Cash clients

Previously: 1% for all clients, 3% for direct deposits over $500, 4% for $100,000 net deposits

Now: 4% for all clients, 4.5% for $100,000 net deposits, 5% for $500,000 net deposits