Speaking of the Palisades fire, I'm not sure if anyone has looked into this yet, but they probably should:

Welcome to the News community!

Rules:

1. Be civil

Attack the argument, not the person. No racism/sexism/bigotry. Good faith argumentation only. This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban. Do not respond to rule-breaking content; report it and move on.

2. All posts should contain a source (url) that is as reliable and unbiased as possible and must only contain one link.

Obvious right or left wing sources will be removed at the mods discretion. Supporting links can be added in comments or posted seperately but not to the post body.

3. No bots, spam or self-promotion.

Only approved bots, which follow the guidelines for bots set by the instance, are allowed.

4. Post titles should be the same as the article used as source.

Posts which titles don’t match the source won’t be removed, but the autoMod will notify you, and if your title misrepresents the original article, the post will be deleted. If the site changed their headline, the bot might still contact you, just ignore it, we won’t delete your post.

5. Only recent news is allowed.

Posts must be news from the most recent 30 days.

6. All posts must be news articles.

No opinion pieces, Listicles, editorials or celebrity gossip is allowed. All posts will be judged on a case-by-case basis.

7. No duplicate posts.

If a source you used was already posted by someone else, the autoMod will leave a message. Please remove your post if the autoMod is correct. If the post that matches your post is very old, we refer you to rule 5.

8. Misinformation is prohibited.

Misinformation / propaganda is strictly prohibited. Any comment or post containing or linking to misinformation will be removed. If you feel that your post has been removed in error, credible sources must be provided.

9. No link shorteners.

The auto mod will contact you if a link shortener is detected, please delete your post if they are right.

10. Don't copy entire article in your post body

For copyright reasons, you are not allowed to copy an entire article into your post body. This is an instance wide rule, that is strictly enforced in this community.

Speaking of the Palisades fire, I'm not sure if anyone has looked into this yet, but they probably should:

Insurance companies are scummy but the headline phrasing makes it seem like they JUST canceled the policies....but no, it was 6 months ago.

As much as I want to hate them for it, can you really blame them? Insurance operates under the measured assumption that most people won't have to use it for some major. When wildfires become probable, it's almost guaranteed to cost them exponentially more than homeowners paid in premiums.

Even if insurance cost $50,000/year, it would take several years of payments to cover the payout. And California has wildfires yearly.

For some reason you made me think of banks being covered by government insurance. In a way you'd think the government would also insure land, seeing as that's one of the main things they protect.

The logistics would probably be horrible for that type of thing though.

Government can print money when appropriate and not abused. Payments directly to the general public are the best type of stimulus. Take a bad situation and make it a stimulus.

Part two though has to be that they are not allowed to receive a payout more than once or make it illegal to build new construction in wildfire zones until they have figured out the forest management issues.

wow, its almost as if we should cut off the heads of insurance CEOs and nationalize them all into one low cost government plan thats paid for with pennies on the dollar in taxes.

lol, who am I kidding. Idiot Americans will always prefer paying 3000 dollars for bad coverage, rather than pay 100 in taxes for great coverage.

With climate change, there is no option for “low cost” plan, government or no.

You can’t constantly have massive losses like these fires in a single area all paying out claims and expect to pay them off with low premiums.

I haven't seen it in the comments yet but this is just the death spiral of climate change. Everything will just get worse from here on out as long as society operates the way it does. To everyone's "surprise" I'm sure.

You had me at cutting off the heads of CEOs.

Guillotines go brrrrrrrrr

When your insurance drops your coverage, that's your cue to GET THE FUCK OUT BEFORE YOU HAVE YET LOST EVERYTHING.

Those actuarial tables are designed from the ground up and refined over literally decades (up to around a century in some cases) to predict risk and while they're not always perfectly accurate they are clearly ENOUGH so that they have made it possible for insurers to remain profitable.

IF THEY KNOW ANYTHING THAT YOU DON'T, THEY ARE DEFINITELY ACTING ON IT.

I know you can't literally just drop everything, or fit absolutely everything that matters to you in your car in a pinch, but you WILL be better off if you've packed up and prepped for transport as many as possible of the things that would hurt you and/or inconvenience you the most to leave behind.

So for those of you who haven't already experienced total loss, learn from this. Prepare yourselves. The people displaced by this will strain many other extant failure points in our society. Shit is about to get MUCH, MUCH WORSE.

Likewise there’s a reason all the billionaires are building bunkers in Hawaii and New Zealand and investing in yachts, that Greenland and northern Canada have new geopolitical and economic importance, and that the Panama Canal is at risk of not being able to get enough traffic across. I’m tired of getting gaslit by climate naysayers.

"Everything is fine!" they say as they stockpile supplies and build secret locations to hide.

The warning bell rang decades ago and we're still ignoring it. There is no escaping or planning around what is to come. It doesn't matter if you move somewhere less impacted by climate change. Those places can't support anywhere close to the amount of people that will need to live there. We'll ruin those places fighting over what scraps remain until there's nowhere left to go.

The entire world basically just tried to ignore COVID and kept burying the bodies hoping everyone would stop caring. (BTW, excess death statistics are still horrifically higher than pre-2019 levels across the world)

Long COVID is a literal debilitating lifelong mental and physical disability but everyone has it now so we just don’t care.

It’s simple. The bourgeois must be eliminated or humanity dies.

This is starting to feel more and more like a planned property grab.

I think it's much simpler honestly: fires like these have been happening every year in California for the past hmm... at least 5 years, maybe more. Insurances are simply catching on and doing what any for-profit company would do in this situation, avoid losing money.

There was a wildfire in the area last month. A couple years ago, a wildfire burned down a bunch of Malibu, a few miles away. I would be very surprised if wildfires in the area stop happening.

I think that maybe the most-reasonable solution is for insurers to just ramp rates way up unless a home is built to be extremely fire-resistant -- just assume that there are going to be wildfires that dump embers in the area sooner or later, and that if your home isn't constrained such that it is able to withstand being showered with embers without going up in flames, that it's going to be insanely costly to insure, because it's likely to burn sooner or later.

Even if one specific house is a concrete bunker, if it's in the middle of normal homes, the bunker still faces potentially 1000 degree temperatures from surrounding homes, and shit's going to burn.

You could pave everything; put in some 100-yard paved firebreaks; who know what else. Or you could just accept that there's going to be a lot of climate refugees fleeing high risk US states. All the heads-in-sand people thinking it was just Tuvalu and Kiribati at risk going to wake up and find out it's LA and Miami, too.

Wildfires are part of the ecology for basically the whole state. Most of the native plants here have evolved to actually depend on and co-exist with routine fire. It's completely normal and natural for this state to burn. The problem is that for 100 years we decided that it should never ever burn at all, so there were many areas of the state that should have burned at least once every ten years that sat there and accumulated unnatural amounts of growth and fuel for ten times that long. So, when we got hit with a megadrought and a fire finally did happen in those places, it was a crazy slate-wiped fire that nothing survived instead of a manageable brush fire that plenty of things would grow back from next year.

Now, is it all bad land management? No, a bunch of shit came together at once to make this message:

California was caught in a mega drought for the better part of a decade and we're still years from our groundwater returning to where it was before the drought.

The Japanese pine beetle killed a lot of pine trees, and that's most of what there is in the Sierra range (yes, there are some oaks and other things, but, well, we're getting there, hold on). So many trees died where they stood that dealing with them all was a nearly impossible task, and beetle-killed wood can't really be used for anything (don't ask me why, but when I was wondering why nobody had come to get all this basically free wood just laying around, that was the answer I got). So, you had huge, huge stands of beetle-kill just standing there, getting drier and drier, waiting for a spark.

The drought also severely dried out lots of other vegetation. There's people I know in the Sierra who said they didn't even have to season their fresh-cut wood. Just chuck it right in the fire, no problem.

Fucking PG&E decided they didn't need to follow best practices because that costs money and spending the money your consumers pay you on stuff that isn't bullshit makes PG&E a sad panda. So, they stopped cutting around their power lines. As someone who partly grew up in the southeast US, this fucking melted my brain. Georgia's a pretty wet, green state, and Georgia Power clear cuts everything down to shin height for probably 50 meters to either side of their transmission lines. Humid-ass Georgia decided they needed it, but we're totally fine to skip it in the Phoenix state, yeah, that makes sense.

So, is climate change to blame? Mostly, yes, climate change is a big, big part of why we're here. Hotter, drier weather with shorter, more intense rain delivery means that the vegetation gets dry faster and stays dry. It means there's less water to fight fires with. That said, it's not the whole picture. There's other ways we could be doing stuff better.

Unfortunately whether intentional or not I think it’ll play out that way specifically for those who could not afford, with time and money, to re-build their homes and buy a new place to live.

For example, parts of Altadena, CA were exempt from redlining, so there is a majority black and brown homeowners in certain neighborhoods who have owned their homes for many years. They couldn’t afford their $1M+ house in today’s market. Insurance will pay them out, but there’s nowhere to live in Altadena now. Maybe some will lease while their home is being rebuilt, but I think many will cash out and buy a new home somewhere else, leaving a lot of opportunity for investors to buy up land and build for-profit housing.

Of course, we now know that insurance companies will not cover some of these properties so may not be a valuable investment, but the community will be forever changed, and I would be surprised if that didn’t include further gentrification.

The issue isn't just local. "This is predicted to cascade into plunging property values in communities where insurance becomes impossible to find or prohibitively expensive - a collapse in property values with the potential to trigger a full-scale financial crisis similar to what occurred in 2008," the report stressed.

I know this isn't the main point of this threadpost, but I think this is another way in which allowing housing to be a store of value and an investment instead of a basic right (i.e. decommodifying it) sets us up for failure as a society. Not only does it incentivize hoarding and gentrification while the number of homeless continues to grow, it completely tanks our ability to relocate - which is a crucial component to our ability to adapt to the changing physical world around us.

Think of all the expensive L.A. houses that just burned. All that value wasted, "up in smoke". How much of those homes' value is because of demand/supply, and how much is from their owners deciding to invest in their resale value? How much money, how much human time and effort could have been invested elsewhere over the years? Notably into the parts of a community that can more reliably survive displacement, like tools and skills. I don't want to argue that "surviving displacement" should become an everyday focus, rather the opposite: decommodifying housing could relax the existing investment incentives towards house market value. When your ability to live in a home goes from "mostly only guaranteed by how much you can sell your current home" to "basically guaranteed (according to society's current capabilities)", people will more often decide to invest their money, time, and effort into literally anything else than increasing their houses' resale value. In my opinion, this would mechanically lead to a society that loses less to forest fires and many other climate "disasters".

I have heard that Japan almost has a culture of disposable-yet-non-fungible homes: a house is built to last its' builders'/owners' lifetime at most, and when the plot of land is sold the new owner will tear down the existing house to build their own. I don't know enough to say how - or if - this ties into the archipelago's relative overabundance of tsunamis, earthquakes, and other natural disasters, but from the outside it seems like many parts of the USA could benefit from moving closer to this Japanese relationship with homes.

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

Look, I get that this is an easy go-to answer for many things, but please add this to expand your understanding a bit more so you have a more complete picture.

Not all insurance companies are public companies with shareholders to satisfy. Mutual Insurance companies are owned by their policy holders. Specifically with California, both State Farm and Liberty Mutual have both exited too. These are both large insurance companies that are NOT driven by "shareholder value". Profits these companies make are issues as dividends to the policy holders, not shareholders.

So the issue of insuring property in California is more than just the standard "greedy shareholders" argument.

This is a really dumb take. Pulling out of a market where it's impossible to even break even is not greedy or corrupt.

Meanwhile the insurance companies are throwing parties right now for pulling out ahead of the disaster. Probably tweaking their models to make sure they're not at risk anywhere else.

Don't worry though, the incoming administration will be working with local governments to prepare for future challenges... Or ignoring them and dismantling any and all efforts to mitigate climate disasters. One or the other.

I think the curious aspect of this is that business is absolutely aware, and acknowledges existence of the climate change.

I'm sorry, are we just skipping over the regulations that caused these companies to pull out? Most of these homes would still be covered. They'd be paying a higher price, but they'd be covered.

When you put a legal cap on costs, the company will pull out.

Funny how the rich argue with climate change when it benefits them. For decades they denied it fiercely and now it's time to pay... even if we take all from them (which we should) it's not enough repair the damages their behavior caused.

Insurance, both property and health, is completing it's morph into a parasitic value extraction tool with zero actual use. They are committing straight fraud at this point, daring people to sue them for contract breach, knowing many won't

Man insurance is such a scam. They'll only actually offer hypothetical coverage if they know you won't need it 😅

Actually need it? "Well, we have to make a profit! Why would we pay for that thing you're paying us to cover?"

Climate change makes risk unpredictable; risk makes insurance unaffordable or unavailable; no insurance makes mortgages unavailable; without mortgages property values crash

Why is it without mortgages property values crash? Is it because sellers are forced to sell to only people who can pay cash? I suppose that makes sense. And of course those won’t be “people”, those will be banks and investment companies, looking to rent the property out to tenants. So more large chunks of money are siphoned away from the middle class.

Man, this thread is reminding me that Lemmy is even worse than Reddit when it comes to being populated by people who have strong opinions about things they don't understand at all.

I FUCKING LOVE MAGNETS

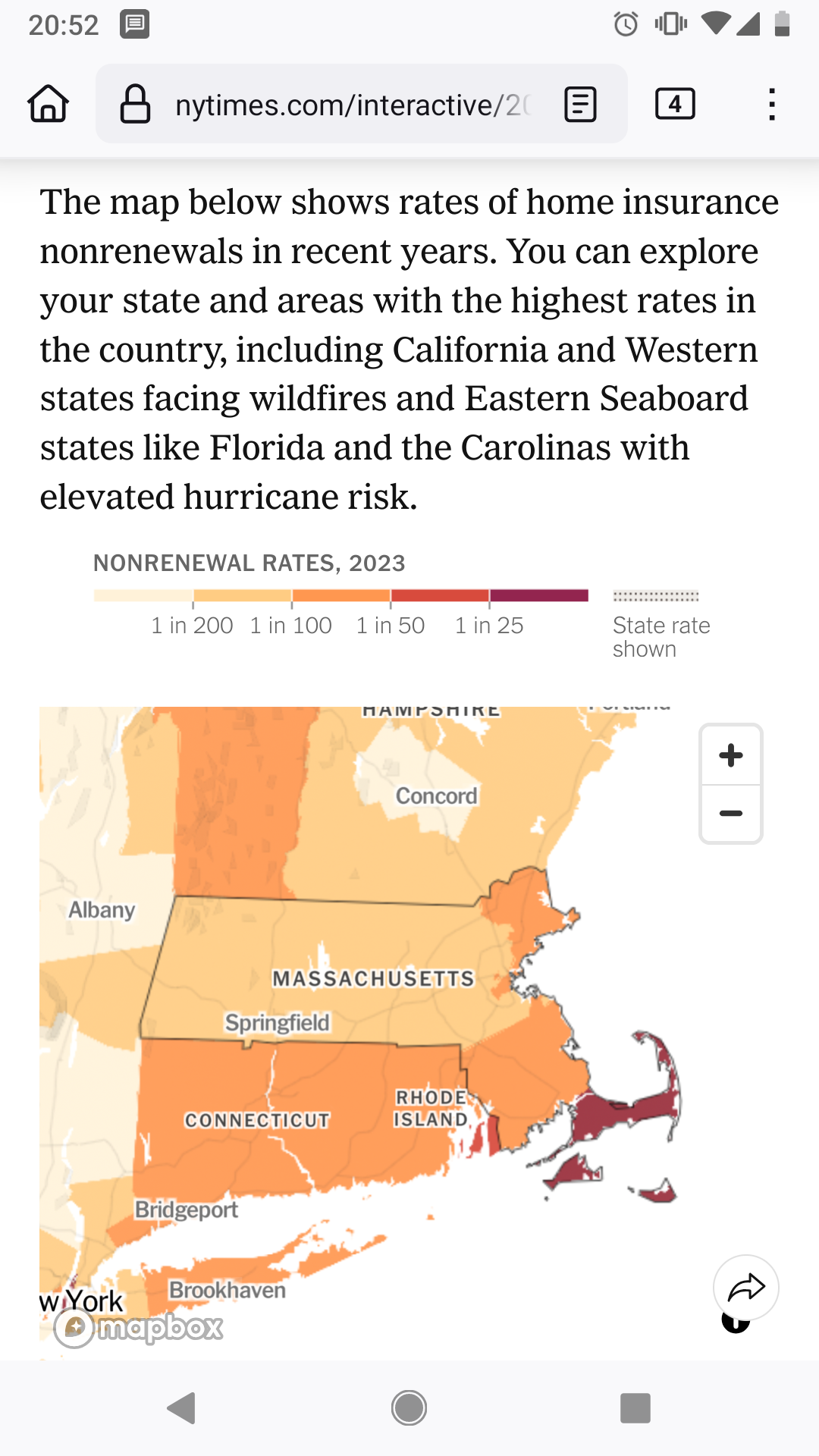

The map below shows rates of home insurance nonrenewals in recent years. You can explore your state and areas with the highest rates in the country, including California and Western states facing wildfires and Eastern Seaboard states like Florida and the Carolinas with elevated hurricane risk.